Pages

21

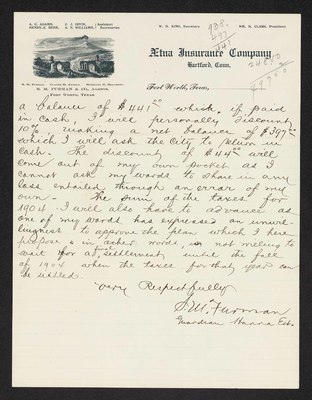

A. C. ADAMS, C. J. IRVIN, } Assistant HENRY.E. REES, A. N. WILLIAMS, } Secretaries

W. H. KING, Secretary

WM. B. CLARK, President

938 497 ----- 441

Ætna Insurance Company Hartford, Conn.

Fort Worth, Texas, Oct 29th 1903

S.M. FURMAN CLAUDE G. ARNOLD, STERLING H. BEAUMONT, S. M. FURMAN & CO., AGENTS FORT WORTH, TEXAS. ___________________

248.50 2 ------------- 497 00

a balance of $441.00 which, if paid in cash, I will personally discount 10%, making a net balance of $397.00 which I will ask the City to return in cash. The discount of $44.00 will come out of my own pocket as I cannot ask my wards to share in any loss entailed through an error of my own. The sum of the taxes for 1904 I will also have to advance as one of my wards has expressed an unwillingness to approve the plan which I have propose = in others wards, is not willing to wait for a final settlement until the fall of 1904 when the taxes for that year can be settled

Very Respectfully S. M. Furman Guardian Hanna Est.

22

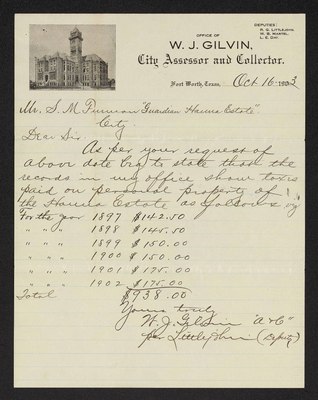

DEPUTIES: R. G. LITTLEON, W.B. MARTEL. L. E. DAY.

OFFICE OF W. J. GILVIN, City Assessor and Collector.

Fort Worth, Texas, Oct 16 1903

Mr. S. M. Furman "Guardian Hanna Estate." City.

Dear Sir.

As per your request of abve date beg to state that the records in my office show taxes paid on personal property of the Hanna Estate as follows viz

For the year 1897 $142.50 " " " 1898 $145.00 " " " 1899 $150.00 " " " 1900 $150.00 " " " 1901 $175.00 " " " 1902 $175.00 Total $938.00

Yours truly W.J. Gilvin "A&C" per Littleohn (Deputy)

23

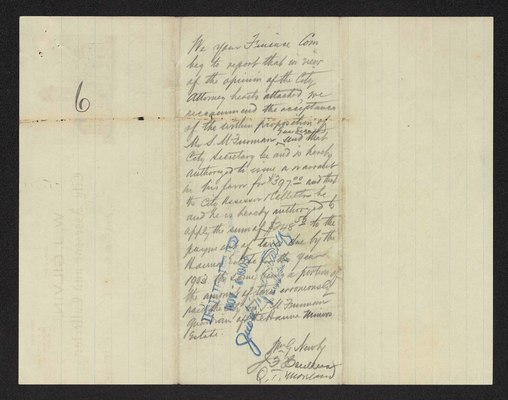

6

We your Finance Com beg to report that in view of the opinion of the City Attorney hereto attached, we recommend the acceptance of the within proposition of Mr. S. M. Furman Guardian and that City Secretary be and is hereby authorized to issue a warrant in his favor for $397.00 and that the City Assessor & Collector be and he is hereby authorized to apply the sum of $248.50 to the payment of taxes due by the Hanna Estate for the year 1903. The same being a portion of the amount of taxes erroneously paid the city by S. M. Furman Guardian of the Hanna Minors Estate.

Wm G Newby J.F. Henderson Q.T. Moreland

24

PHONE 798, 3 RINGS

R. W. FLOURNOY LAWYER

ROOMS 306-7 HOXIE BUILDING NOTARY IN OFFICE

FORT WORTH, TEXAS, July 21st. 1903.

Q. T. Moreland, Atty at Law.

Natatorium Bldg., Fort Worth, Texas.

Dear Moreland:-

I send you herewith brief on the tax matter as requested. Please read it as the weather is hot and I went to some trouble to write it. Preserve this copy as I may want to use it in some other connection.

Very truly yours, RW Flournoy

Dic. R.W.F. Enclosure.

25

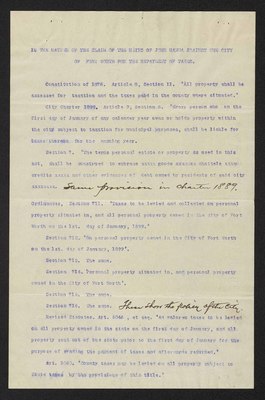

IN THE MATTER OF THE CLAIM OF THE HEIRS OF JOHN HANNA AGAINST THE CITY OF FORT WORTH FOR THE REPAYMENT OF TAXES.

Constitution of 1876. Article 8, Section 11. "All property shall be assessed for taxation and the taxes paid in the county where situated."

City Charter 1899. Article 9, Section 5. "Every person who on the first day of January of any calender year owns or holds property within the city subject to taxation for municipal purposes, shall be liable for taxes thereon for the ensuing year.

Section 7. "The terms personal estate or property as used in this act, shall be construed to embrace xxxxx goods xxxxxxx chattels xxxxx credits xxxxx and other evidences of debt owned by residents of said city xxxxxxxx. Same provision in charter 1889.

Ordinances, Section 711. "Taxes to be levied and collected on personal property situated in, and all personal property owned in the city of Fort Worth on the 1st. day of January, 1899."

Section 712. "On personal property owned in the City of Fort Worth on the 1st. day of January, 1899".

Section 713. The same.

Section 714. "Personal property situated in, and personal property owned in the City of Fort Worth".

Section 715. The same.

Section 716. The same. These show the policy of the City.

Revised Statutes. Art. 5046 , at seq. "Ad valorem taxes to be levied on all propery owned in the state on the first day of January, and all property sent out of the state prior to the first day of January for the purpose of evading the payment of taxes and afterwards returned."

Art. 5050. "County taxes may be levied on all property subject to State taxes by the provisions of this title."