Pages

31

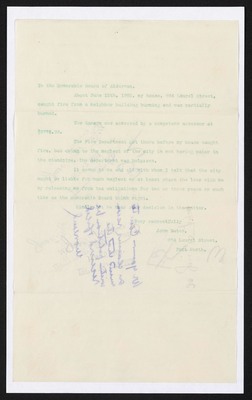

To the Honorable Board of Aldermen,

About June 12th, 1902, my house, 804 Laurel Street, caught fire from a neighbor building burning and was partially burned.

The damage was assessed by a competent assessor at $3775.99.

The Fire Department got there before my house caught fire, but owing to the neglect of the city in not having water in the standpipe, the department was helpless.

It seems to me and all who I talk that the city ought to be liable for such neglect or at least share in the loss with me by releasing me from tax obligations for two or three years of such time as the Honorable Board think right.

Kindly let me hear your decision in the matter.

Yours respectfully, John Bates, 804 Laurel Street, Fort Worth,

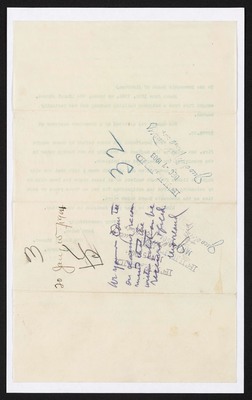

32

3

20 Jany 15/1904

15

32

We your Committeee on claims recommend that the written petition be received and filed.

Moreland F. E. Dycus

FILED JAN 15 1904 Jno T. Montgomery City Sec'y

FILED JAN 1 1904 Jno T. Montgomery City Sec'y

FILED DEC 7 1903 Jno T. Montgomery City Sec'y

33

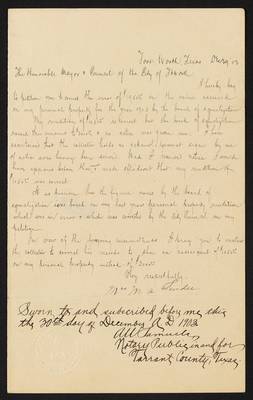

Fort Worth, Texas, Dec 29 '03

The Honorable Mayor & Council of the City of Ft. Worth

I hereby beg to petition you to correct the error of $1950.00 in the valued assessed on my personal property for the year 1903 by the board of equalization.

My rendition of 1050.22 is correct but the board of equalization raised this amount to $3000.00 & no notice was given me. I have ascertained that the collector holds no acknowledgement signed by me of notice ever having been served. Had I received notice I would have appeared before that board & made affidavit that my rendition of $1050.00 is correct.

It is possible that the figure named by the board of equalization was based on my last years personal property rendition which was in error & which was corrected by the City Council on my petition.

In view of the foregoing circumstances I pray you to instruct the collector to correct his records to show an assessment of $1050.00 on my personal property instead of $3000.00.

Very respectfully, Mrs. M. A. Fender

Sworn to and subscribed before me this the 30th day of December A.D. 1903. A. W. Samuels Notary Public in and for Tarrant County, Texas.

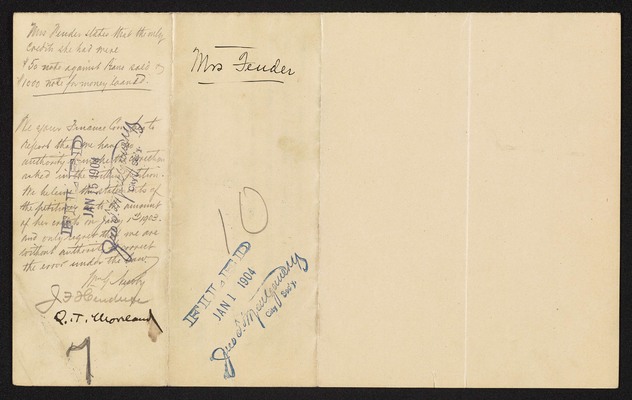

34

Mrs. Fender states that the only credits she had were $50 note against [Piano?] sold & $1000 note for money loaned.

We your Finance Com beg to report that we have no authority to make the correction asked in the within petition. We believe the statements of the petitioner as to the amount of her credits on Jany 13 1903, and only regret that we are without authority to correct the error made under the law.

Wm. G. Newby J. F. Henderson Q. T. Moreland

7

FILED JAN 15 1904 Jno T. Montgomery City Sec'y

35

Ft.Worth Texas, Jan.1st.1904.

To The Honorable Mayor and City Council of Fort Worth:

Your petitioner John Ward respectfully represents that in rendering his property for taxation for the year 1903, which consisted of a stock of merchandise, that a mistake was made to his prejudice in this.

That his property was taken by the assessor of taxes, from his invoice book, at the full invoice price, when it is customary to take this kind of property at a discount of 20 percent from the full invoice of the same. That the value of his stock of merchandise was fixed by the assessor at the sum of $6502.00, when it should have been fixed at 20 per cent less than this sum, or at the sum of $5202.00. That he did not discover that this mistake was made until he paid his taxes on the 29th. day of December 1903.

Therefore your petitioner prays that your honorable body will refund him all taxes paid on his property over and above a valuation of $5202.00.

Respectfully submitted, John Ward by G. M. Templeton His Attorney.