Pages

51

G. H. DAY, ASSESSOR AND COLLECTOR.

T. P. LENOIR, LEM E. DAY, DEPUTIES.

City of Fort Worth OFFICE OF ASSESSOR AND COLLECTOR

Fort Worth, Texas, 1-12 1903

To the Hon. Mayor & City Council,

Gentlemen,

Your petitioner would hereby state and am ready to verify on oath that my lot no 19 in Block 4 of Union Depot Addition was assessed in 1902 at $1000.00 including the house. The lot was assessed at $200.00 & house at $800.00 and as the house was built after the 1st day of January 1902 I beg that your honorable body authorise the Tax Collector to recieve the Tax on the lot alone at the value of $200.00 which would amount to $350.00. Earnestly praying for this relief I am your obedient servant.

H. R. Zimmerman

Sworn to and subscribed before me this 18th day of June 1903.

J. J. Nunnally Notary Public Tarrant Co. Tx.

52

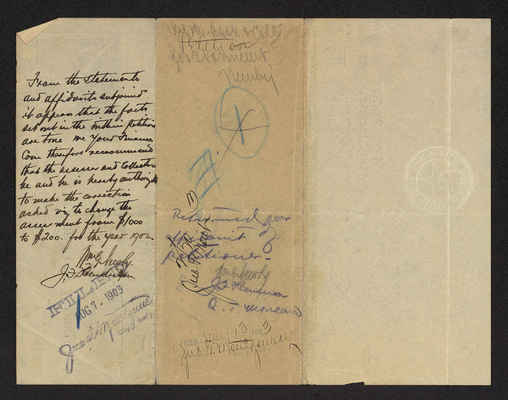

[column 1]

From the statements and affidavits subjorned it appears that the facts set out in the within petition are true. We your Finance Com. therefore recommend that the Assessor and Collector be and he is hereby authorized to make the correction asked viz to change the assessement from $1000 to $200 for the year 1902.

Wm. G. Newby J. F. Henderson

FILED AUG 7 1903 Jno T. Montgomery City Sec'y

[column 2]

Petition

Ref to Assr. & Coll. for statement.

Nunnally

1 39

Returned for affidavit of petitioner.

Wm. G Newby J. F. Henderson Q. T. Moreland

FILED 2/20 1903 Jno T. Montgomery City Secretary

FILED June 13 1903 Jno T. Montgomery City Secretary

53

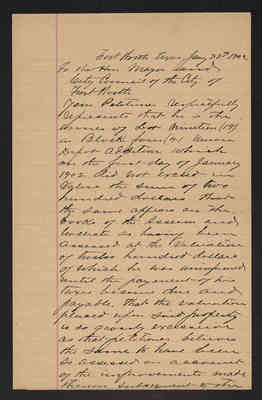

Fort Worth Texas Jany 23rd 1903

To the Hon. Mayor and City Council of the City of Fort Worth

Your petitioner respectfully represents that he is the owner of Lot nineteen (19) in Block four (4) Union Depot Addition which on the first day of January 1902 did not exceed in value the sume of two hundred dollars. That the same appears on the books of the Assessor and Collector as having been assessed at the valuation of twelve hundred dollars of which he was uninformed until the payment of his taxes became due and payable. That the valuation placed upon said propery is so grossly excessive as that petitioner believes the same to have been so assessed on account of the improvements made thereon subsequent to the

54

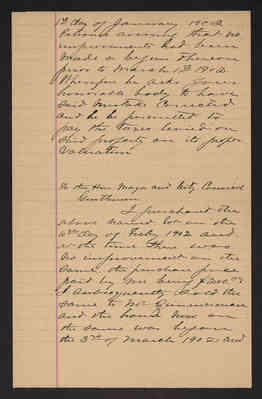

1st day of January 1902. Petitioner asnwering that no improvements had been made or begun thereon prior to March 1st 1902. Wherefore he asks your honorable body to have said mistake corrected and he be permitted to pay the taxes levied on said property on its proper valuation.

To the Hon. Mayor and City Council

Gentlemen

I purchased the above named lot on the 6th day of Feby 1902 and at the time there was no improvement on the same, the purchase price paid by me being $200.00. I subsequently sold the same to Mr. Zimmerman and the house now on the same was before the 3rd of March 1902 and