Pages

31

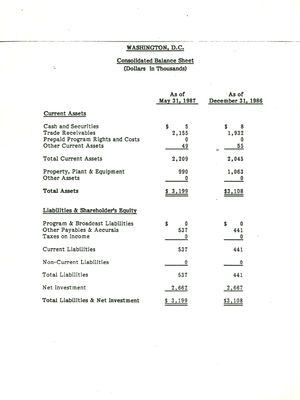

WASHINGTON, D.C. CONSOLIDATED BALANCE SHEET (Dollars in Thousands)

Current Assets Cash and Securities As of May 31, 1987 As of December 31, 1986 $5 $8

Trade Receivables As of May 31, 1987 As of December 31, 1986 2,155 1,932

Prepaid Program Rights and Costs As of May 31, 1987 As of December 31, 1986 0 0

Other Current Assets As of May 31, 1987 As of December 31, 1986 49 55

Total Current Assets As of May 31, 1987 As of December 31, 1986 2,209 2,045

Property, Plant & Equipment As of May 31, 1987 As of December 31, 1986 990 1,063

Other Assets As of May 31, 1987 As of December 31, 1986 0 0

TOTAL ASSETS As of May 31, 1987 As of December 31, 1986 $3,199 $3,108

LIABILITIES & SHAREHOLDER'S EQUITY

Program & Broadcast Liabilities As of May 31, 1987 As of December 31, 1986 0 0

Other Payables & Accurals As of May 31, 1987 As of December 31, 1986 537 441

Taxes on Income As of May 31, 1987 As of December 31, 1986 0 0

Current Liabilities As of May 31, 1987 As of December 31, 1986 537 441

Non-Current Liabilities As of May 31, 1987 As of December 31, 1986 0 0

Total Liabilities As of May 31, 1987 As of December 31, 1986 537 441

Net Investment As of May 31, 1987 As of December 31, 1986 2,662 2,667

TOTAL LIABILITIES & NET INVESTMENT As of May 31, 1987 As of December 31, 1986 $3,199 $3,108

32

Antonio L. Harrison [Information Redacted]

October 7, 1987

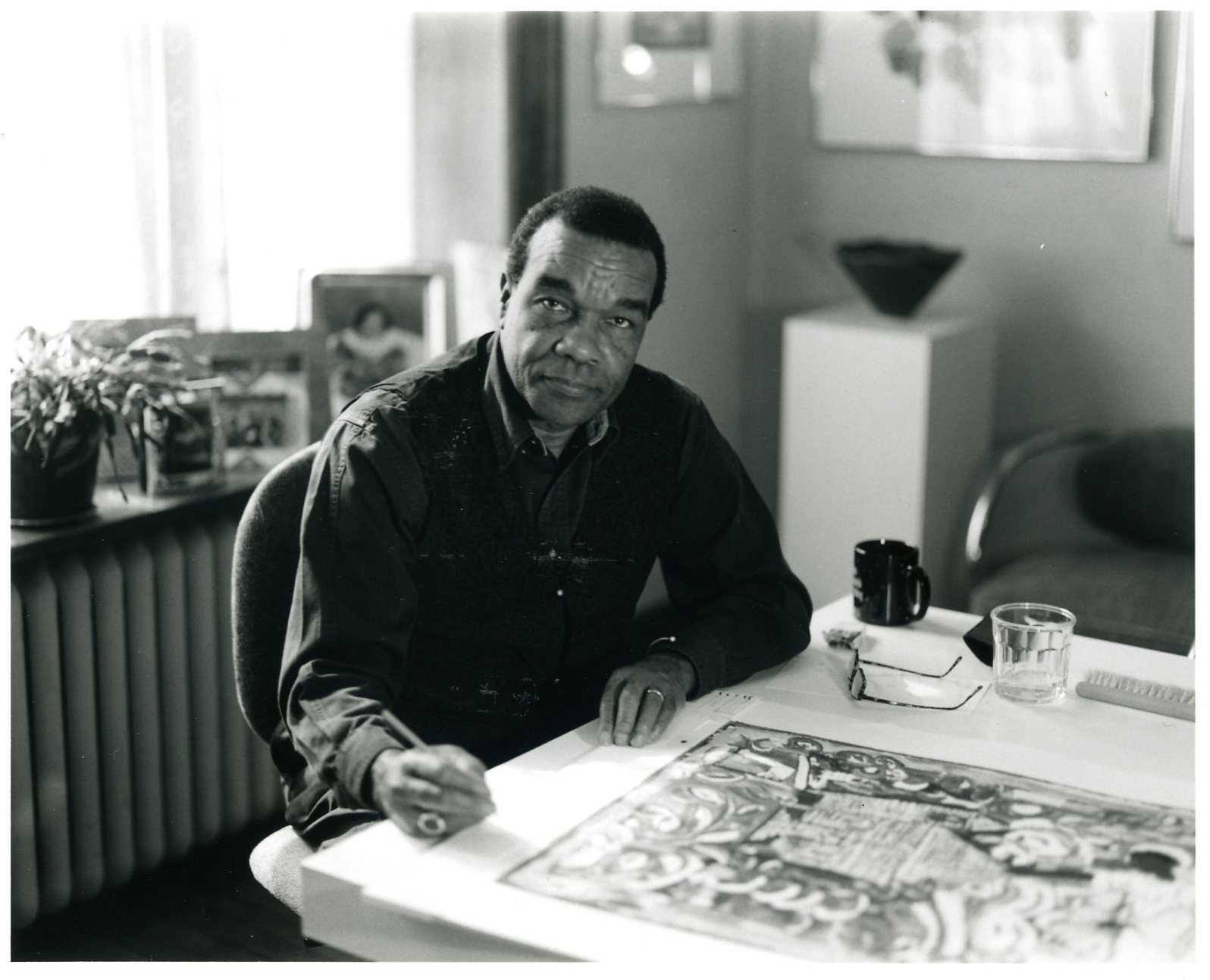

Mr. David C. Driskell [Information Redacted]

Dear Mr. Driskell: [The words "Mr. Driskell" crossed out and replaced with a handwritten "David"]

This note is sent as an updated since our last conversation concerning your participation in the acquisition group of a major radio property--KYS-D.C. We have been moving forward on several fronts: securing the financial data from the seller, identifying an investment banker, and identifying potential financing.

We have established direct contact with the seller--NBC-- and have been directed to Kidder Peabody, its investment banker. The enclosed letter from the President of NBC Radio to our legal counsel, Curtis White, would suggest that the financial data should be available within short order. Mr. White will be in further contact with Kidder Peabody next week to determine the status of the financial information. One of the enclosed news article provides some indication of what the range of the purchase price might be-- at least, the bottom range.

I have had conversations with contacts at both Goldman Sachs and Drexel Burnham Lambert regarding serving as investment banker for our group in this transaction. Further discussions will be held with both once we have received the financial information and have determined if we are going to proceed with this effort.

Since our initial conversation, I have been moving forward to identify potential equity and debt moneys. The response has been a "qualified" positive in most of the discussions held to date. These responses were qualified in the same manner as yours, that is, pending a review of financial data.

We are proceeding on the assumption of purchasing with a down-payment of approximately ten percent (10%). We anticipate the use of the minority purchase program which grants deferral of the capital gain through the issuance of a tax certificate through the FCC (See enclosure).

Thank you for your consideration of this effort. I believe that we may have an excellent opportunity at hand. While I am sure we will not be the only group moving to acquire this property, I am confident that at this time we are poised for potential success. You shall next hear from me after receipt of the financial data.

Sincerely yours, /S/ "Tony" Antonio L. Harrison

Enclosure

33

[NBC Radio Letterhead] NBC Radio National Broadcasting Company 30 Rockefeller Plaza New York, NY 10112 212-664-2364

Randall D. Bongarten President

September 1, 1987

Mr. Curtis T. White Hunton & Williams [Information Redacted]

Dear Mr. White:

Thank you for your letter expressing your client's interest in our Washington station WKYS-FM.

We are preparing an offering memorandum for WKYS. Our investment firm, Kidder, Peabody & Company, will contact you once our documents have been completed. That should be within the next few weeks.

Thank you once again for your interest in the NBC Radio properties. I'll look forward to speaking with you in the near future.

Sincerely, /S/ Randall D. Bongarten

cc: G. Blemaster - Kidder, Peabody & Co.

34

[The Washington Post, Tuesday, June 30, 1987 p. D7 Tearsheet]

On the Dial

WKYS, WASH Up for Sale

By Jeffrey Yorke Washington Post Staff Writer

NBC-owned WKYS-FM (93.9) and Metropolitan's WASH-FM (97.1) Thursday joined Metroplex-owned WCXR-FM (105.9) and sister-station WCPT-AM (730) in the for-sale category. Metroplex partners announced earlier this month that they would look at offers beginning at $20 million for classic rock WCXR and satellite-fed soul oldies WCPT.

Although NBC officials refused to reveal an asking price, observers estimate the value of urban contemporary WKYS at $45 million to $50 million. Recently, NBC had indicated it would try to keep its stations and its radio news network, but last week's change of heart -- which also included selling Chicago powerhouse WMAQ-AM and San Francisco Giants' flagship KNBR-AM -- is "for a variety of strategic reasons," NBC Radio President Randy Bongarten said yesterday.

In a letter sent to all NBC radio employes, Bongarten said the network also plans "to pursue a station acquisition program while we position our radio stations to operate as competitively as possible." NBC will develop a "buy some, sell some" program while "reconfiguring our station portfolio." Bongarten said NBC's radio news network is still seen "as viable and attractive."

One NBC insider summed up the letter: "It says we're staying in the radio business."

Yesterday, Bongarten said the announcement was "the result of a relatively long and detailed planning process, which began when GE bought RCA (which owns NBC) a year and a half ago."

Metropolitan, formed last fall following a leveraged buyout of nine radio stations and the Texas State Network by Metromedia management, will sell WIP-AM, once a Philadelphia mainstay, as well as WASH in order to "strengthen its financial situation," according to WASH-FM General Manager Tom Durney.

"WIP" is a struggling AM, but WASH can command big bucks," said Durney, who estimated the price tag for "Easy 97" at $25 million to $30 million and guessed that Metropolitan has received 14 or 15 offers already.

35

The Washington Post Friday, October 2, 1987

Senate Bill Keeps FCC's Minority Plan By Davod A. Vise Washington Post Staff Writer

The Federal Communication Commission would be forced to keep its minority tax certificate program under a provision of the agency's appropriations bill now before the Senate. The FCC's minority tax certificate program encourages the sale of radio and television stations to minorities by giving a tax break to the seller. The agency is reviewing the program and two related preference procedures to determine if they should be continued. The appropriations bill would force the agency to end the review and continue the programs. The programs, which favor minorities and women over other potential buyers of radio and television stations, have been under FCC review to determine if they are constitutional, accoriding to Diane Killory, the agency's general counsel. "We are not speeding anything up out of the ordinary course of business," Killory said yesterday, when asked if the FCC would move to abandon the programs before the appropriation bill becomes law. "If it is signed into law, then the commission will comply with the statute." Killory added that the FCC has not been "lobbying or anything like that." Congressional soucres said the provision was attached to the appropriations bill at the request of Sens. Frank R. Lautenberg (D-NJ) and Lowell P. Weicker Jr. (R-Conn.), who feared the FCC would abandon the program on grounds it discriminates against white males. Earlier this year, the largest station sale ever under the minority tax certificate program was criticized by some supporters of the program, who charged that it was a "sham." The deal involved Gaylord Broadcasting Co's $365 million sale of its Tampa television station to a corporation controlled by attorney Clarence McKee and Nashville broadcast executive George Gillett. Since McKee is black, Gaylord recieved a tax certificate from the FCC that permits the company to defer tens of millions of dollars in taxes on gains from the sale of the station. Because Gaylord recieved the tax break, the company was willing to sell the Tampa station to Gillett, an established operator of television stations, and McKee, for about $100 million less than other bidders would have been required to pay, Wall Street sources said. Although McKee put no money into the deal, he received 21 percent of the stock of the corporation that now owns the Tampa station. After two years, Gillett has the option to buy McKee's stake for at least $1 million.