Pages

21

ORRICK & TERRELL LAWYERS ROOMS 5,6 & 7 POWELL BUILDING PHONE 379 FORT WORTH, TEXAS

To the Hon Mayor & City Council

Gentlemen

Taking the facts as set forth in the foregoing petition as true I am of opinion that the valuation can not be lowered as requested but in accordance with my opinion in the matter of Mrs H F Musick this day filed I am of opinion that a proper case arises for a settlement on the [preamble?] that the city could not by tax sale sell the property for enough to realize its debit

I am not advised of the truth of this facts set up but with my opinion on the facts presented

In case settlement should be made the city thereon requires payment of such a sum as it could realize out of the property reasonably by selling it under a tax title.

Respectfully Submitted

EC Orrick City Atty

23

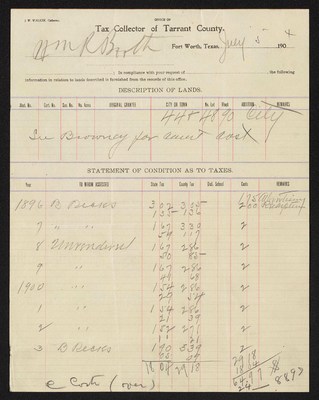

J. W. WALKER, Collector

OFFICE OF Tax Collecter of Tarrant County.

Fort Worth, Texas, July 5 1904

______________________

__________________, In compliance with your request of ______________ the following information in relation to lands described, is furnished from the records of this office:

DESCRIPTION OF LANDS

| Abst. No. | Cert. No | Sur No. | No. Acres | ORIGINAL GRANTEE | CITY OR TOWN | No. Lot | Block | ADDITION | REMARKS | |

|---|---|---|---|---|---|---|---|---|---|---|

| 44 + | 48 | 90 | City |

STATEMENT OF CONDITION AS TO TAXES.

| Year | TO WHOM ASSSESSED | Sales Tax | County Tax | Dist. School | Costs | REMARKS |

|---|---|---|---|---|---|---|

| 1896 | BRicks | 3.02 | 3.05 | 1.75 | Advertising | |

| 1.35 | 1.36 | 2.00 | [Recarpten?] | |||

| 7 | " " | 1.67 | 3.30 | 2 | ||

| .59 | 1.17 | |||||

| 8 | Unknown | 1.67 | 2.86 | 2 | ||

| .50 | .85 | |||||

| 9 | " | 1.67 | 2.86 | 2 | ||

| .41 | .68 | 2 | ||||

| 1900 | " | 1.54 | 2.86 | 2 | ||

| .29 | .54 | |||||

| 1 | " | 1.54 | 2.86 | 2 | ||

| .21 | .39 | |||||

| 2 | " | 1.52 | 2.71 | 2 | ||

| .11 | .21 | |||||

| 3 | B Ricks | 1.90 | 5.39 | 2 | ||

| .05 | .09 | |||||

| 18.04 | 29.18 | 29.18 | ||||

| 18.04 | ||||||

| 64.97 $ | ||||||

| 24__ | ||||||

| 8897 |

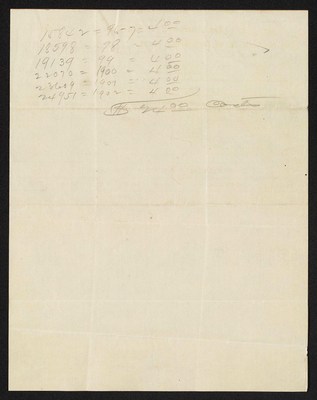

25

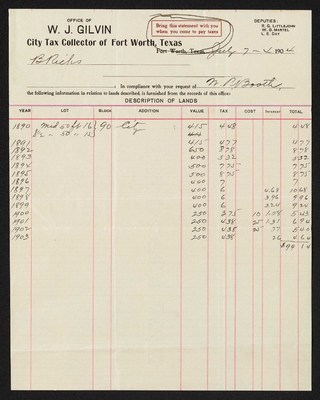

DUPUTIES: R.G. LITTLEJOHN. W.B.MARTEL. L.E.DAY.

OFFICE OF W. J. GILVIN, City Assessor and Collector.

Bring this Statement with you when you come to pay taxes.

Fort Worth, Texas, July 7-4-1904

B Ricks

______________________

__________________, In compliance with your request of W.RBooth the following information in relation to lands described, is furnished from the records of this office:

DESCRIPTION OF LANDS

| YEAR | LOT | BLOCK | ADDITION | VALUE | TAX | COST | INTEREST | TOTAL |

|---|---|---|---|---|---|---|---|---|

| 1890 | Mid 50ft 16} | 90 | City | 415 | 4.48 | 4.48 | ||

| S 1/2 " 50 " 15} | ||||||||

| 1891 | 415 | 4.77 | 4.77 | |||||

| 1892 | 650 | 8.78 | 8.78 | |||||

| 1893 | 400 | 5.32 | 5.32 | |||||

| 1894 | 500 | 7.75 | 7.75 | |||||

| 1895 | 500 | 8.75 | 8.75 | |||||

| 1896 | 400 | 7. | 7. | |||||

| 1897 | 400 | 6. | 4.68 | 10.68 | ||||

| 1898 | 400 | 6. | 3.96 | 9.96 | ||||

| 1899 | 400 | 6. | 3.24 | 9.24 | ||||

| 1900 | 250 | 3.75 | .10 | 1.58 | 5.43 | |||

| 1901 | 250 | 4.38 | .25 | 1.31 | 6.94 | |||

| 1902 | 250 | 4.38 | .25 | .77 | 5.40 | |||

| 1903 | 250 | 4.38 | .26 | 4.64 | ||||

| $99.14 |