Pages

1

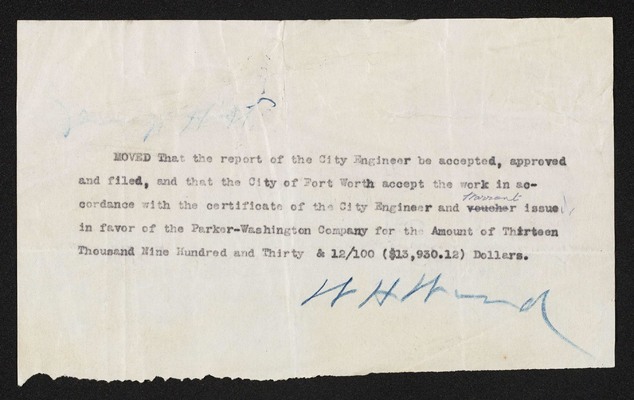

MOVED That the report of the City Engineer be accepted, approved and filed, and that the City of Fort Worth accept the work in accordance with the certificate of the City Engineer and voucherwarrant issue in favor of the Parker-Washington Company for the Amount of Thirteen Thousand Nine Hundred and Thirty & 12/100 ($13,930.12) Dollars.

W. H. Ward

3

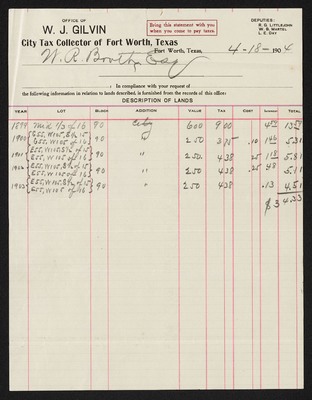

OFFICE OF W. J. GILVIN, City Tax Collector of Fort Worth, Texas

DEPUTIES: R. G. LITTLEJOHN, W. B. MARTEL, L. E. DAY.

Bring this statement with you when you come to pay taxes.

Fort Worth, Texas, 4-18-1904

W.R. Broth Esq

_______________________________ ___________________, in compliance with your request of __________________ the following information in relation to lands described, is furnished from the records of this office:

DESCRIPTION OF LANDS

| YEAR | LOT | BLOCK | ADDITION | VALUE | TAX | COST | INTEREST | TOTAL |

|---|---|---|---|---|---|---|---|---|

| 1899 | Mid 1/3 of 16 | 90 | City | 600 | 9.00 | 4.59 | 13.59 | |

| 1900 | {E55. W105, S 1/2 15 } | 90 | " | 250 | 3.75 | .10 | 1.46 | 5.31 |

| { E55. W105 of 16} | ||||||||

| 1901 | {E55. W105. S 1/2 of 15} | 90 | " | 250. | 4.38 | .25 | 1.18 | 5.81 |

| {E55. W105 of 16} | ||||||||

| 1902 | {E55. W105. S 1/2 of 15} | 90 | " | 250. | 4.38 | .25 | .48 | 5.11 |

| {E55. W105 of 16} | ||||||||

| 1903 | {E55. W105. S 1/2 of 15} | 90 | " | 250. | 4.38 | .13 | 4.51 | |

| {E55. W105 of 16} | ||||||||

| $34.33 |

4

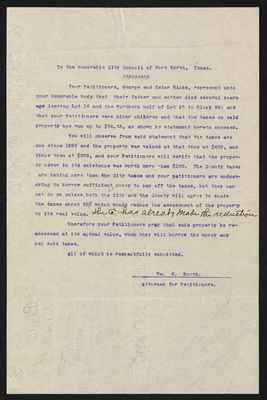

To the Honorable City Council of Fort Worth, Texas.

#########

Your Petitioners, George and Ester Ricks, represent unto your Honorable Body that their father and mother died several years ago leaving Lot 16 and the Northern half of Lot 15 in Block 90; and that your Petitioners were minor children and that the taxes on said property has run up to $34.33, as shown by statement hereto annexed.

You will observe from said statement that the taxes are due since 1899 and the property was valued at that time at $600, and since then at $250, and your Petitioners will verify that the property never in its existance was worth more than $150. The County taxes are behind more than the City taxes and your petitioners are endeavoring to borrow sufficient money to pay off the taxes, but they can not do so unless both the City and the County will agree to scale the taxes about 50% which would reduce the assessment of the property to its real value. The Co. has already made the reduction

Wherefore your Petitioners pray that said property be reassessed at its actual value, when they will borrow the money and pay said taxes.

All of which is respectfully submitted.

Wm. R. Booth. Attorneoy for Petitioners.

5

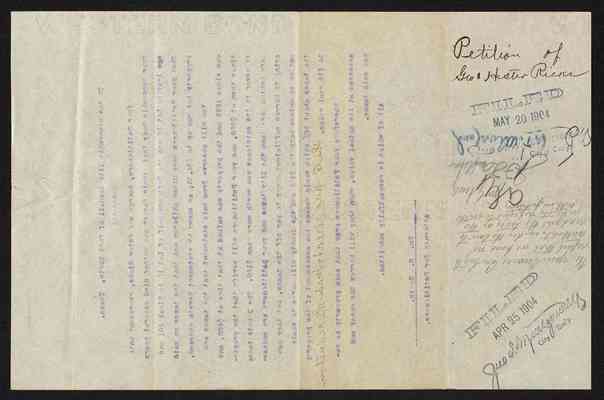

Petition of Geo & Hester Ricks

FILED MAY 20 1904 Jno T. Montgomery City Sec'y

35

[upside down] We your Finance Com beg to report that we have no authority under the law to readjust the taxes on the property referred to in the within petition

Wm G Newby JF Henderson Q.T. Moreland

5 [/upside down

FILED APR 25 1904 Jill T. Moulgouer City Sec'y.